The Federal Government’s proposed Carbon Capture Tax Credit, initially designed to propel carbon capture initiatives towards net-zero emissions by 2050, now raises eyebrows as experts uncover potential support for oil extraction.

Contents

- 1 Carbon Capture Tax Credit Raises Concerns:

- 2 Controversial Changes in Carbon Capture Legislation

- 3 Environmentalists Decry ‘Rollback’ in Carbon Capture Initiatives

- 4 Industry Optimism and Concerns Over Monitoring

- 5 Tax Credit Provides Industry ‘Flexibility’

- 6 Carbon Capture Technology Faces Skepticism Amid Global Climate Crisis

Carbon Capture Tax Credit Raises Concerns:

Experts warn that the federal government’s proposed tax credit, aimed at promoting carbon capture and achieving net-zero emissions by 2050, may inadvertently subsidize oil production. The initial promise, outlined in the 2021 budget, excluded projects involving enhanced oil recovery (EOR).

However, a recent draft of the legislation reveals that projects utilizing up to 90% of captured carbon for EOR will qualify for the Carbon Capture tax credit. Critics, including Julia Levin from Environmental Defence, assert that this inclusion represents a significant rollback, essentially supporting oil production rather than reducing emissions.

Tax Credit Eligibility Breakdown:

| Usage of Captured Carbon | Tax Credit Eligibility |

|---|---|

| Dedicated Storage | Yes |

| EOR (up to 90%) | Yes |

NEW: Earlier this week, the Carbon Capture Coalition submitted comments in response to the Internal Revenue Service’s proposed guidance on #directpay and transferability priorities for the #45Q tax credit. Learn more on our website here:https://t.co/0qBAi2DUaL

— Carbon Capture Coalition (@CCSTechFacts) August 17, 2023

Controversial Changes in Carbon Capture Legislation

The impending legislation for the carbon capture tax credit, set to be tabled in the coming weeks, has sparked controversy. Despite assurances in the 2021 budget that the investment tax credit would not apply to EOR projects, the latest draft introduces a shift. Projects using captured carbon for dedicated geological storage, with up to 90% for EOR, can still access the tax credit for the portion allocated to storage. This change has raised concerns about the government’s commitment to emission reduction goals.

“Balancing environmental goals with industry interests is a delicate act. The controversy over the carbon capture tax credit underscores the challenges in achieving this equilibrium.” – Environmentalist

Environmentalists Decry ‘Rollback’ in Carbon Capture Initiatives

Environmentalists, including Julia Levin, have criticized the revised Carbon Capture Tax credit, labeling it a significant departure from the initial promise. Levin argues that any projects involving EOR components should be ineligible for federal support, emphasizing the importance of prioritizing emission reduction over oil production subsidies. The controversy underscores the challenges in crafting legislation that effectively balances environmental goals with industry interests.

Industry Optimism and Concerns Over Monitoring

While industry proponents, such as Beth Valiaho from the International CCS Knowledge Centre, welcome the tax credit’s flexibility, concerns persist. Jason MacLean, a climate policy specialist, warns that the current formulation lacks clarity on promoting genuine geological storage projects. The reliance on project plans and the potential for manipulation raises questions about monitoring and ensuring the Carbon Capture tax credit benefits projects aligned with emission reduction objectives.

Am donating $100M towards a prize for best carbon capture technology

— Elon Musk (@elonmusk) January 21, 2021

Must Read – Elon Musk’s X Under Fire: Unlabeled Ads Scandal Revealed by Check My Ads

Tax Credit Provides Industry ‘Flexibility’

Despite the criticism, some industry analysts, like Anetta McKenzie from the Pembina Institute, view the tax credit as a strategic move to maintain competitiveness. McKenzie acknowledges that the tax credit, in its current form, sets a lower bar for subsidized projects. This, she argues, allows the oil and gas industry the flexibility needed for developing nascent carbon capture technology, especially in the face of competition from similar incentives in the United States.

Carbon Capture Facilities in Canada:

| Province | Number of Facilities | EOR Usage |

|---|---|---|

| Alberta | 6 | Yes |

| Others | 2 | No |

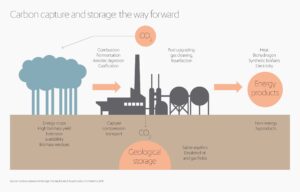

Carbon Capture Technology Faces Skepticism Amid Global Climate Crisis

The International Energy Agency’s recent report questioning the efficacy of carbon capture technology adds to the skepticism surrounding the proposed tax credit. Over 400 scientists and academics have previously urged Finance Minister Chrystia Freeland to reconsider the credit. Critics emphasize that carbon capture projects, even without EOR components, may not effectively address emissions, as the majority occur during the consumption of oil and gas by end-users.

As the government prepares to unveil the legislation, the controversy surrounding the carbon capture tax credit highlights the delicate balance between promoting environmental goals and supporting the oil and gas industry. The inclusion of EOR projects has sparked concerns of a potential setback in emission reduction efforts. The coming weeks will reveal the extent to which the government addresses these concerns and aligns the tax credit with its commitment to a cleaner, sustainable future.