In a strategic move, the Arizona State Retirement System increased its stake in Microsoft Corp (NASDAQ: MSFT) by 4.5% during the 2nd quarter, as revealed in its recent 13F filing with the Securities and Exchange Commission (SEC).

The retirement fund now owns an impressive 2,021,390 shares of the tech giant, marking a substantial addition of 87,770 shares during the reporting period. With Microsoft constituting approximately 5.6% of its investment portfolio, it secures its position as the retirement system’s second-largest holding. The market value of Arizona State Retirement System’s Microsoft holdings reached a noteworthy $688,364,000 at the close of the reporting period.

Arizona State Retirement System’s MSFT Holdings

| Quarter | Total Shares Owned | Current Value ($) |

|---|---|---|

| Till 2nd Quarter of 2023 | 2,021,390 | $688,364,000 |

Contents

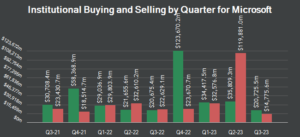

Hedge Funds Join the Bandwagon

The Arizona State Retirement System is not alone in recognizing Microsoft’s investment appeal. Other key players in the financial landscape, including hedge funds and institutional investors, have also been active participants in the market dynamics.

Monumental Financial Group Inc. initiated a new stake in MSFT during the 1st quarter, valued at approximately $28,000. Meanwhile, Syverson Strege & Co augmented its position by 157.0%, now holding 203 shares valued at $58,000. MayTech Global Investments LLC entered the arena during the 4th quarter, investing about $83,000. Beutel Goodman & Co Ltd. increased its stake by 57.5%, closing the 3rd quarter with 411 shares valued at $95,000. Alapocas Investment Partners Inc. made a notable entrance in the 1st quarter, with an investment of around $97,000. Currently, institutional investors and hedge funds collectively own 69.20% of MSFT’s outstanding shares.

Analysts Bullishness on Microsoft’s Prospects

Financial analysts on Wall Street remain bullish on Microsoft, as evident from recent reports. Citigroup, on October 26th, raised the price target from $430.00 to $432.00, maintaining a “buy” rating. BMO Capital Markets, on July 26th, gave an “outperform” rating. Piper Sandler, on October 25th, raised its price target to $425.00, endorsing an “overweight” rating.

Wedbush echoed similar sentiments advising an “outperform” rating. Wells Fargo & Company reiterated an “overweight” rating. With four analysts holding a “hold” rating and thirty-five advocating a “buy” rating, the stock has garnered an average rating of “Moderate Buy” and a consensus price target of $385.11, according to MarketBeat.com data.

Wall Street Analyst Ratings (Cont.)

| Analyst | Rating | Price Target ($) |

|---|---|---|

| Citigroup | Buy | $432.00 |

| BMO Capital Markets | Outperform | $400.00 |

| Piper Sandler | Overweight | $425.00 |

| Wedbush | Outperform | $425.00 |

| Wells Fargo & Company | Overweight | $400.00 |

Note: Data based on the most recent analyst reports.

Insider Transactions: Leadership Moves

In notable insider transactions, EVP Kathleen T. Hogan sold 26,815 shares on Friday, September 1st. The shares were sold at an average price of $327.37, resulting in a total transaction value of $8,778,426.55. Post-transaction, Hogan directly holds 198,373 shares, valued at $64,941,369.01.

Additionally, CEO Satya Nadella sold 38,234 shares on the same day at an average price of $328.43, translating to a total value of $12,557,192.62. Following this sale, Nadella holds 800,668 shares, valued at approximately $262,963,391.24. Insider transactions are tracked meticulously and can offer insights into the confidence leadership places in the company’s future.

Strong Financials

In its most recent quarterly earnings report on October 24th, MSFT demonstrated robust financial performance. The software giant reported earnings per share (EPS) of $2.99, surpassing analysts’ consensus estimates by $0.34. Notably, achieved a net margin of 35.31% and a return on equity of 38.79%.

The company recorded revenue of $56.52 billion for the quarter, outperforming analyst estimates of $54.52 billion. This represents a significant 12.8% year-over-year increase in quarterly revenue. Analysts anticipate MSFT to post $11.13 EPS for the current fiscal year.

Market Performance

On Friday, MSFT opened at $369.85, reflecting a 1.7% decline. The fifty-day moving average stands at $336.17, while the two-hundred-day moving average is slightly higher at $331.59. Microsoft’s market cap currently hovers around $2.75 trillion, with a PE ratio of 35.80 and a price-to-earnings-growth ratio of 2.46. The company’s beta is 0.88, indicating a moderate level of market volatility. Over the past twelve months, Microsoft’s stock has ranged from a low of $219.35 to a high of $376.35.

Must Read: Elon Musk’s X Under Fire: Unlabeled Ads Scandal Revealed by Check My Ads

Generous Dividends

Investors in MSFT can also celebrate a positive dividend update. The company recently announced a quarterly dividend, payable on Thursday, December 14th. Shareholders of record on Thursday, November 16th, will receive a dividend of $0.75 per share.

This marks an increase from its previous quarterly dividend of $0.68, reflecting the company’s commitment to rewarding shareholders. The ex-dividend date for this dividend is Wednesday, November 15th. With a dividend payout ratio (DPR) of 29.04%, MSFT continues to be an attractive option for income-focused investors.

Global Tech Powerhouse

Microsoft Corporation, a global tech giant, extends its influence by developing and supporting software, services, devices, and solutions worldwide. The company’s Productivity and Business Processes segment encompasses a range of offerings, including Office, Exchange, SharePoint, Office 365 Security and Compliance, Microsoft Viva, and Microsoft 365 Copilot.

Additionally, MSFT caters to office consumer services, offering Microsoft 365 consumer subscriptions, Office licensed on-premises, and various other office services. As it continues to innovate and adapt to the evolving tech landscape, its position as a leader in the industry remains unwavering.

Microsoft and OpenAI partnership

Microsoft and OpenAI (Chat GPT) deepened their collaboration with a recent extension of their partnership, as announced on January 23, 2023. This strategic alliance aims to foster innovation and accelerate advancements in artificial intelligence (AI).

The extended partnership underscores the commitment of both entities to pushing the boundaries of AI research and development. By combining MSFT’s technological prowess with OpenAI’s cutting-edge AI capabilities, the collaboration seeks to address complex challenges and drive progress in the field. This extension marks a significant step towards harnessing the potential of AI to positively impact various industries and shape the future of technology.

In conclusion, Microsoft’s appeal as an investment continues to gain traction, evident in the increased stake by the Arizona State Retirement System and the positive sentiments echoed by financial analysts on Wall Street. The company’s strong financial performance, strategic leadership moves, and generous dividends contribute to its attractiveness in the market. As the Company navigates the dynamic tech landscape, its commitment to innovation and shareholder value positions it as a formidable player in the industry.

FAQ

Q: How much did Arizona State Retirement System increase its stake in Microsoft?

A: Arizona State Retirement System increased its stake in Microsoft by 4.5%, acquiring an additional 87,770 shares during the 2nd quarter.

Q: What is Microsoft’s current market cap?

A: Microsoft’s market cap stands at a staggering $2.75 trillion as of 20.Nov.2023.

Q: When is Microsoft’s next dividend payout scheduled?

A: Microsoft’s next dividend payout is scheduled for Thursday, December 14th.

Q: How did Microsoft’s recent earnings compare to analyst estimates?

A: Microsoft reported $2.99 EPS for the quarter, surpassing analysts’ consensus estimates by $0.34.

Q: What is the average rating and price target for Microsoft according to Wall Street analysts?

A: Based on MarketBeat.com, Microsoft has an average rating of “Moderate Buy” with a consensus price target of $385.11.